Things to Look for When Choosing a Merchant Account Provider

Summary: If you are looking for a merchant account provider for your business, read below for some things to consider before making a purchase.

Running a small business can be challenging. Unlike a larger, more established company, a small business in its early stages can be much more limited, whether that be with employees, space for operations, or money. If you want to start accepting credit card transactions, you will want to set up a merchant account.

There simply isn’t a one-size-fits-all approach for choosing a provider, so you will want to figure out what sort of needs you have when looking around. Continue reading for some things to consider when shopping for a merchant account provider.

Online and Offline

Depending on the kind of business you want to run, you will have to choose if you want to have a physical store, an online store, or a combination of the two. It is possible you may want to initially start with a physical store and decide to open up an online shopping portal with an ecommerce merchant account later on, or vice-versa. The last thing you would want to do is have to switch account providers or open up an additional one if your current provider is unable to meet your operational needs. To avoid this, look for a merchant account provider that is capable of handling both kinds of transactions.

Customer Support

If you run into an issue with your company’s transactions, you will want to be able to get a hold of someone immediately. Look for a merchant account provider that offers solid customer support and is easy to contact. Charge.com, for example, offers 24/7 phone and email support. Some providers even offer live chat support, for added convenience. If a potential provider has odd contact hours and will not be available to handle any questions or concerns whenever they might arise, it may be worth it to take your business elsewhere.

What Makes a Digital Wallet Quality?

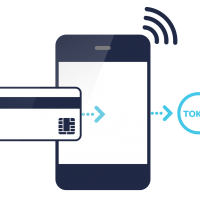

A digital wallet is a piece of software that helps users move money using the Internet. Modern digital wallets utilize layers of encryption in order to ensure every transaction is private. This process is called “tokenization”, and it is used to make data anonymous and create a disposable session where the transaction can take place.

All that is useful, but it doesn’t help us understand how to shop for a great digital wallet. What qualities should you look for when you’re deciding where to store your money online? Here are some thoughts on what makes a quality digital wallet.

Basics

Stanford has some helpful ideas on what basics you should be looking for as a consumer. The best digital wallets are extensible, meaning they can handle any of the payment methods you may choose to use at a given moment. Vendors also shouldn’t be able to initiate transactions without your explicit say-so, thus making security extremely important.

Low fees are another great quality to look for, and those are achieved by re-using the same technology. You’ll never get a behind-the-scenes peak at this portion, so shop around for the lowest fees you can find.

And finally, Stanford concludes that digital wallets should be able to run on any device. You shouldn’t need your PC to complete any online credit card processing transaction, especially since smartphone adoption rates are rising.

Other Qualities

Other qualities to look for include discounts and special offers. More merchant account providers like Charge.com are working directly with retailers to make sure they offer personalized discounts to customers using these payment methods.

Bitcoin: Basics for International Transactions

Bitcoins are exchanged online in a fashion similar to cash, but the anonymous currency works differently than most real forms of currency. Bitcoin is becoming a great method to exchange cash for services, and more credit card merchant services are beginning to show gradual acceptance of it.

When you sign up for a service, such as Bitcoin Core, you will receive a digital wallet tied to an account. You can login to this account from any desktop or mobile device, and it comes with an address. That address is used to transfer bitcoins to and from your wallet.

Many retailers are beginning to accept currency from digital wallets, but not every retailer is working with Bitcoin just yet. If you’re not going to exchange your bitcoins for cash, you should prepare yourself to do a little bit of research on who might accept what form of currency. Also, remember that Bitcoin is the most popular form of cryptocurrency, but others exist. That said, not every form of cryptocurrency is as acceptable or even remotely stable as Bitcoin is.

You can buy Bitcoins using your currency’s exchange rate, or you can set up a system to mine for them. Mined Bitcoins take time to find, and require some technical knowhow to setup, but they can provide a steady stream of Bitcoins for your wallet.

Each transaction is recorded to a central ledger system. This system not only tracks how many Bitcoins were spent, but it uses a sophisticated algorithm to verify ownership of a coin and record the transaction taking place. Every transaction abides by these rules.

Desktop clients must download the entire blockchain, which is always growing. Mobile users utilize a streamlined form of Bitcoin’s blockchain, instead relying on nodes to pass information on behalf of the user. This results in an accurate ledger without consuming too much data to use the service.

Another amazing innovation is that Bitcoin wallets have multiple methods for backup. You can take your records offline, back them up to another digital device and use multiple signatures to help verify your transactions.

Excited about Bitcoin yet? Make sure you purchase your currency from a reputable exchange, or invest through a mining operation that you trust. Make some phone calls and try out this exciting new form of currency. You could be investing on the ground floor of a historic new form of cash.

Blog submitted by Charge.com. Find out why Charge.com was rated the #1 merchant provider on the Web for six years running, and how affordable it can be to accept credit cards online, at Charge.com.

Tips to Reduce Costly Chargebacks on Your Merchant Account

Merchant account holders pay per transaction, but if there is a chargeback on the account then they can be charged even more online payment processing. Chargebacks are essentially disputes between the credit card company, and the business owner. The customer usually initiates chargebacks, and there can be steep penalties for businesses who accumulate too many. This guide will help you avoid chargebacks using best practices.

Merchant account holders pay per transaction, but if there is a chargeback on the account then they can be charged even more online payment processing. Chargebacks are essentially disputes between the credit card company, and the business owner. The customer usually initiates chargebacks, and there can be steep penalties for businesses who accumulate too many. This guide will help you avoid chargebacks using best practices.

Be Upfront

Your customers should know what they are buying, and how much it will cost them. Provide as much of that data as possible. If you’re hosting sellers, make sure they aren’t violating your terms of service by selling and shipping inferior builds of their products. Integrity will go a long way in reducing chargebacks for merchant services, and should be a cornerstone of any ecommerce marketplace.

Offer Refunds

You might not want to offer refunds because it means giving money back, but it’s much better than a dispute. Refunds are a happy medium, a good method for you and the customer to work a dispute out on your own. Offer them.

Be Wary

Fraudulent transactions tend to raise red flags. Look for bulk orders that were placed at the same time, and flag all big ticket item transactions for personal review. You should also require the CVV or CVV2 code at the credit card terminal, or online, when the customer completes a transaction, but it’s ok to do this periodically if you have the customer’s account information on file.

Be Fast

Customers want their purchases as soon as possible, and will complain if fulfillment takes too long. Not only does this hurt your reputation, it can lead to chargebacks. Combat this by fulfilling orders quickly, and creating a system to verify purchases so you don’t make costly mistakes.

Bio: With no setup or cancellation fees, Charge.com is one of the highest rated merchant account providers on the Web.

Your Guide to Updating Credit Card Terminals

Credit card machines are evolving at a rapid pace, and businesses are finding themselves facing important decisions regarding when and how to upgrade. Upgrading is a necessity with chip cards coming to your local store, but how far should you go before you’ve taken care of the necessities for your business? While every business will be different, these guidelines should help you come to some basic conclusions as you look through your options.

Future Proofing

As you’re looking at what might be your new credit card swipe machine, consider some important concepts that you might have to deal with in the future:

- eCommerce: are you prepared to host a payment processor online in order to accept payments through your website? If not, you might miss out on potential business.

- Mobile: can your credit card machine accept mobile payments? Are your staff members equipped with mobile payment processors?

- Security: Another concern is security. Hacking isn’t going away, it’s going to get worse as time goes on. Smaller stores who can’t afford state of the art security are going to become targets. Upgrading will help shield your company from some of that liability.

The bottom line is that you need to consider the next 5-10 years of this technology, instead of the next one or three.

Final Thoughts

Updating isn’t cheap, but it is integral to the future of your business. Don’t make this decision until you’ve looked at the needs of your business. When you’re ready, try and future proof your purchases by looking into the future and studying trends in retail and customer service.

Charge.com Payment Solutions, Inc. has been voted the number one merchant account provider for retail, mobile and eCommerce businesses for six years running.